Contents

1.0 Exploratory Data

Visualization

1.8 Characteristics of the Top

App Developer Companies

1.10 Rated Apps Rating

Distribution

2.1 Summary Statistics of the

numeric variables

2.1.2 Feature statistics of

the sample:

2.2 Distribution of the

Ratings in sample data

2.2.3 Whether the App supports

Ads

2.3 Correlations of the numeric

variables

2.5.1 Feature Statistics of

Outliers

2.6.2 Scatter Plot of the

Highly Correlated Features

2.7 Unsupervised Machine

Learning

3.0 Supervised Machine

Learning

3.1 Target Variable

(Rated/Unrated)

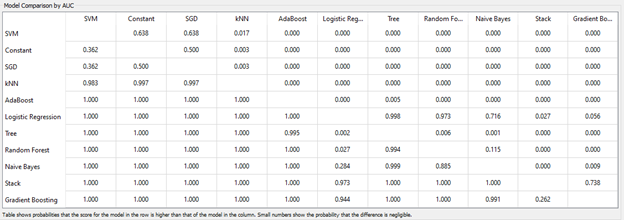

3.5 Model Comparison by AUC

(Area Under the Curve)

3.8 Target Variable (App

Rating)

0.0

Dataset

0.1

Source

Google Play Store Apps | Kaggle

0.2

Variables

Contains data of 600k+ Google Play Store Android App. The data was updated on June 2021. It as 2.3 million+ rows and 24 columns/attributes. The following attributes are present. Not all of the attributes were used for data analysis.

|

Time/Period |

Nominal Variables |

Categorical Variables |

Numerical Variables |

|

Released |

App Id |

Category |

Installs |

|

Last Updated |

App Name |

Minimum Installs |

Maximum Installs |

|

Developer Id |

Currency |

Price |

|

|

Developer Website |

Minimum Android |

Rating Count |

|

|

Privacy Policy |

Content Rating |

Size |

|

|

Developer Email |

Ad Supported |

||

|

In app purchases |

|||

|

Editor Choice |

|||

|

Rating |

|||

0.3

Working Files

Link to Software Files: Google Drive

The link contains the software files for Tableau, and Orange used in this assignment.

1.0

Exploratory Data Visualization

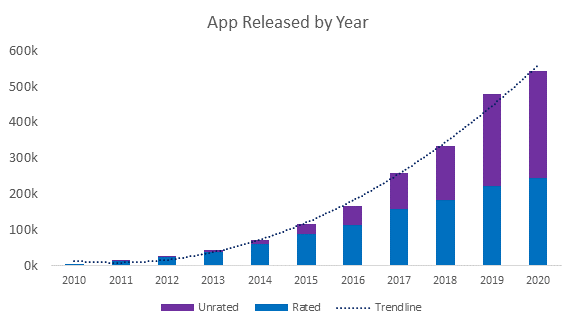

1.1

App Release Pattern

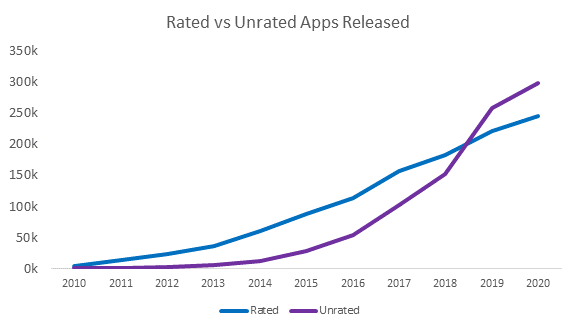

Insights: The total number of apps released have increased at an increasing rate. We can expect more apps to be released in the coming years based on the pattern.

Insights: However, unrated apps have increased at a faster rate than rated apps. Although, the proportion of unrated apps was very low in the first few years of play store, the number of unrated apps was greater than rated ones by 2019.

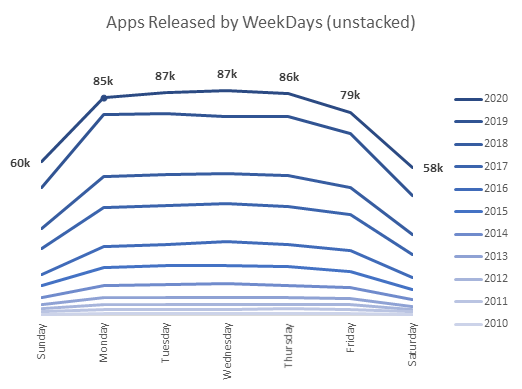

Insights: Less apps are released on the weekends comparatively. This pattern has been seen on every year. Furthermore, the rate of releases seems to increase till Wednesday, before starting to drop again.

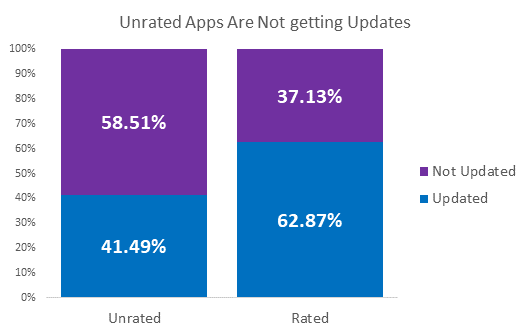

1.2

Updating Apps

Insights: When an app is not rated there is around 60% chance that it was not updated in the future. In the case of rated apps, 60% get updated eventually. (in making the chart, apps released till 2019 were taken, as apps released later might not have gotten time to get updated)

1.3

Ad placement in Apps

Top Categories Without Apps

|

Category |

Ad not Supported |

Ad Supported |

|

Business |

87% |

13% |

|

Shopping |

82% |

18% |

|

Events |

75% |

25% |

|

Medical |

75% |

25% |

|

Finance |

75% |

25% |

Insights: None of the categories having less ads were games. Furthermore, these categories are service oriented that might require financial transactions, and ads need not be placed for extra revenue.

Top Ad Supported Categories

|

Category |

Ad not Supported |

Ad Supported |

|

Racing |

9% |

91% |

|

Word |

11% |

89% |

|

Simulation |

11% |

89% |

|

Trivia |

12% |

88% |

|

Music |

13% |

88% |

Insights: Categories that include many apps with ads are “games”. Furthermore, there might be less options for in-app purchase in such categories, hence ads are placed for revenue generation (disambiguation: music category is a games category, “music and audio” is a non-game category)

1.4

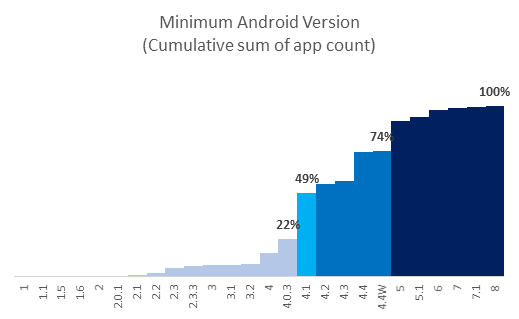

Apps & Android Version

Insights: Only 22% apps can be run on android version below 4.1. On the contrary, only 26% apps restrict android versions below 5. We can expect, that when new android versions will be released, there will be more apps that would not be usable in older phones. Android users can consider buying a phone with higher android version based on the insight.

1.5

App Rating

App Ratings

|

Category Type |

Good (4 or above) |

Bad (below 4) |

Unrated |

|

Games |

42% |

24% |

34% |

|

Others |

35% |

17% |

48% |

|

Grand Total |

36% |

18% |

46% |

Insights: About half of the apps that are not games remain unrated. Whereas, there is only a 1 in 3 probability that a game app will go unrated.

App Ratings (Rated Apps)

|

Category Type |

Good (4 or above) |

Bad (below 4) |

|

Games |

64% |

36% |

|

Others |

67% |

33% |

|

Grand Total |

67% |

33% |

Insights: However, for rated apps, we see that similar proportion of apps got rated above 4. One explanation might be that, games categories do not have as many apps as the other ones. Hence, they do not go unnoticed often. When the apps are noticed by people, similar ratings are available for games and other categories.

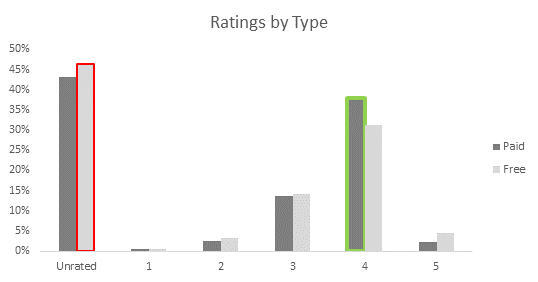

Insights: Paid apps are rated better than the free ones (green highlight). At the same time, free apps are more unrated in comparison to the paid ones. (Rating 5 is not being considered as rating 5 is easily possible through a small number of rating by the owners or their friends. The ‘ratings vs installs” chart provided later confirms this assumption)

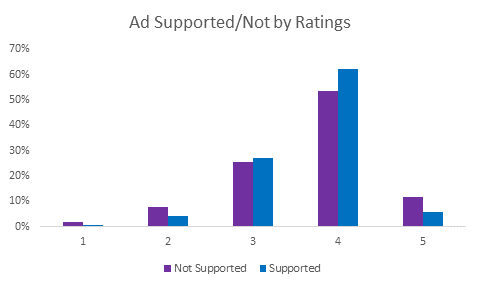

Insights: Ad supported apps have higher proportion of good ratings and a lower proportion of bad ratings.

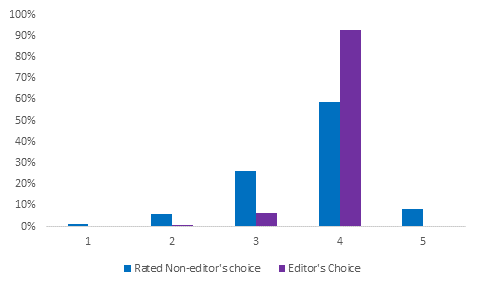

Insights: A greater portion of Editor’s Choice apps get a better rating when compared to apps not labeled editor’s choice.

1.6

App Category

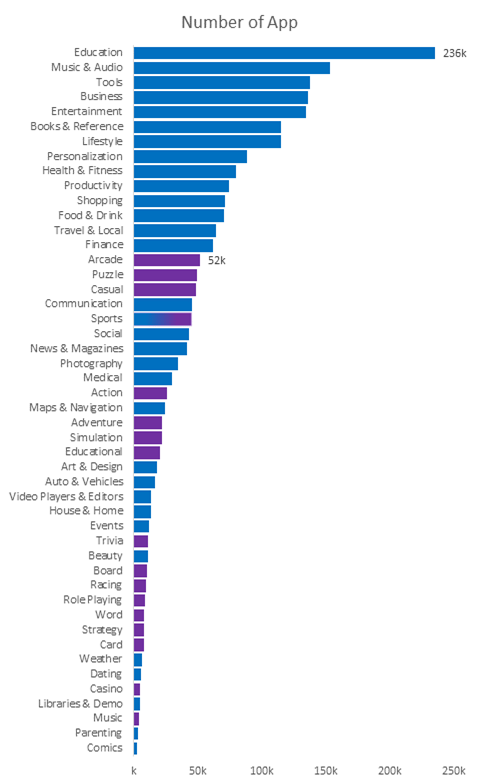

Insights: Education category has the highest number of apps.

The first games category (15th overall) in the descending order of

app counts is “Arcade” with less than 1/4th of education category

apps.

Comics category has the least

number of apps. Whereas, Music category is the games category with the lowest

number of apps.

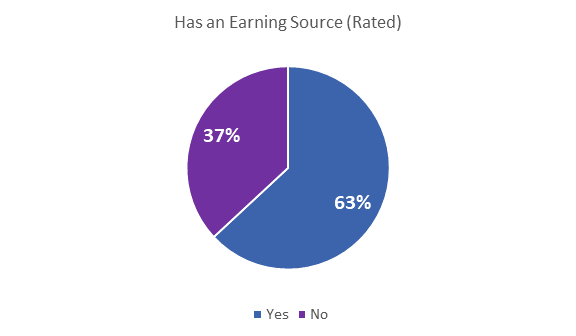

1.7 Revenue Generating Apps

Insights: There were 3 earning sources identified in this case:

ads, in-app purchase and paid apps. 37% of the play store apps did not have any

of those as an earning source. (Unrated apps were not used in this analysis).

1.8 Characteristics of the Top App Developer Companies

|

Developers with 1000+ Apps |

Avg. Rating (Rated Only) |

Rated |

Unrated |

|

app smart GmbH |

4.43 |

26% |

74% |

|

Apptegy |

4.24 |

7% |

93% |

|

ArtStyle |

4.33 |

8% |

92% |

|

BH App Development Ltd |

4.07 |

1% |

99% |

|

Branded Apps by MINDBODY |

4.20 |

15% |

85% |

|

Branded MINDBODY Apps |

3.59 |

3% |

97% |

|

ChowNow |

3.74 |

6% |

94% |

|

Currency Converter X Apps |

4.51 |

14% |

86% |

|

CyJ Studio |

4.30 |

5% |

95% |

|

Echurch |

4.88 |

27% |

73% |

|

Flipdish |

3.87 |

9% |

91% |

|

FoodSoul |

4.04 |

33% |

67% |

|

J&M Studio |

3.96 |

4% |

96% |

|

Lingua Apps |

4.20 |

30% |

70% |

|

Magzter Inc. |

3.86 |

41% |

59% |

|

MINDBODY Branded Apps |

4.15 |

8% |

92% |

|

Multiple Radios Online AM FM Free - Apps |

3.94 |

3% |

97% |

|

OrderYOYO |

4.39 |

8% |

92% |

|

Phorest |

4.51 |

2% |

98% |

|

Sharefaith |

4.88 |

7% |

93% |

|

Skalpelis |

3.18 |

4% |

96% |

|

Subsplash Inc |

4.84 |

44% |

56% |

|

TRAINERIZE |

4.06 |

2% |

98% |

|

TTMA Apps |

4.26 |

27% |

73% |

|

Virtuagym Professional |

4.70 |

57% |

43% |

|

+Home by A team |

4.43 |

98% |

2% |

Insights: Among the app developers with 1000+ apps, +Home by A

team seems to be the best in terms of getting noticed (98% rated apps).

Contrarily BH App Development Ltd are the worst in terms of at least getting

rated (1% rated apps). Echurch and Sharefaith are the best with high average of

rated apps. Interestingly, both of them are related to religious practices. It

is also noticeable that a most of these developers developing thousands of apps

did not keep quality in mind.

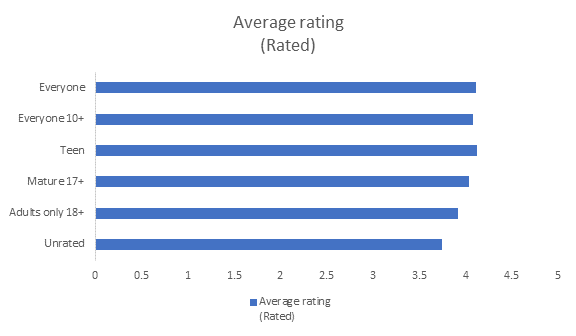

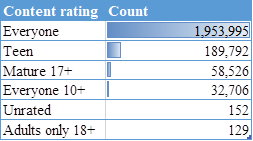

1.9 Content Rating

Insight: As the age limitation increases, the average rating

decreased.

Number of Apps by

Content Rating

Insight: At the same time, the number of age restricted apps

are less in comparison to apps with content rating “Everyone”

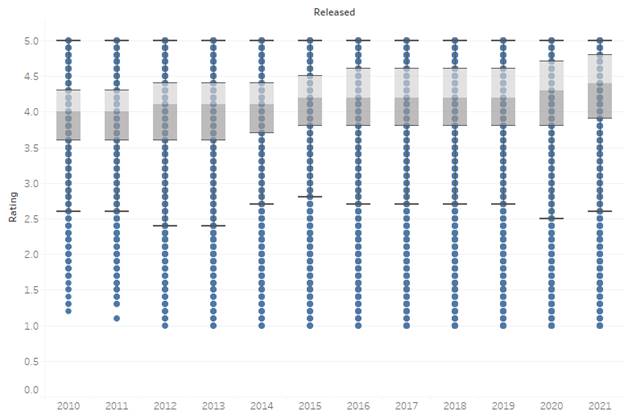

1.10 Rated Apps Rating Distribution

Insights: The overall rating distribution for apps are shown

above. The median rating has increased over time consistently, which is a good

sign of the increasing quality of apps. However, the lower quartile range

fluctuated with no specific pattern.

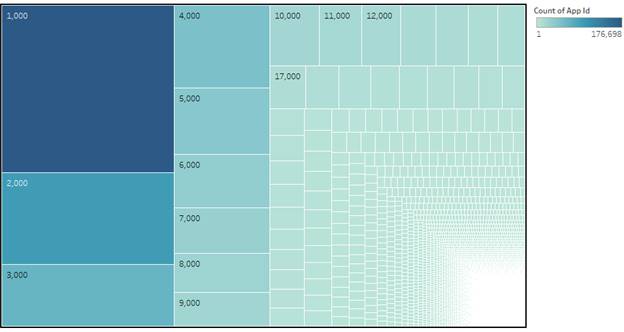

1.11 Number of Installs

Insights: Lesser number of apps have high volume of downloads.

Most apps have a small number of downloads.

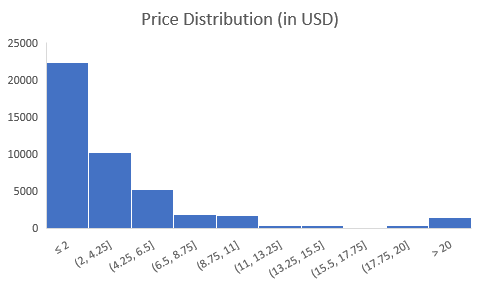

1.12 Paid Apps

Insights: The price distribution for paid apps have been shown

above. Most of the apps are priced under $2. Prices can get as high as $400,

but they have a lower frequency.

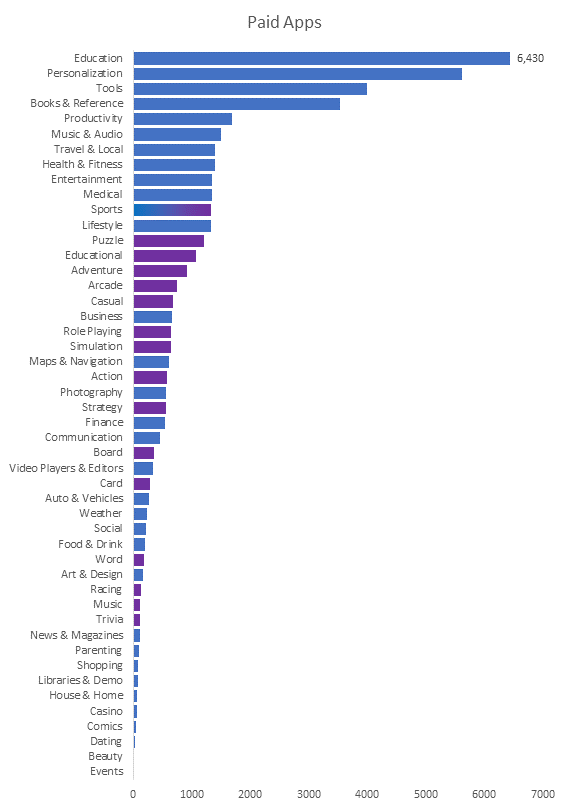

Insights: Education category has the highest number of apps that

are paid. Puzzle category is the most common paid games category.

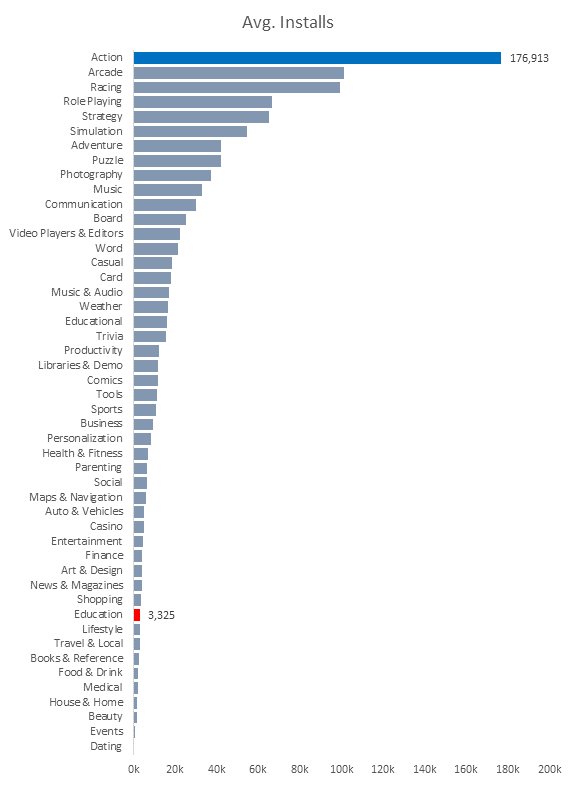

Insights: Although education category has the highest number of

paid apps, they are not installed as much. Arcade categories have a higher

average number of installs in comparison instead.

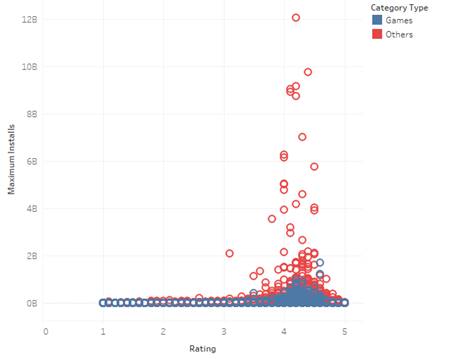

1.13 Ratings vs Installs

Insights: Higher number of installs are found for apps rated

slightly above 4. However, not many of the apps with high downloads are rated

as high.

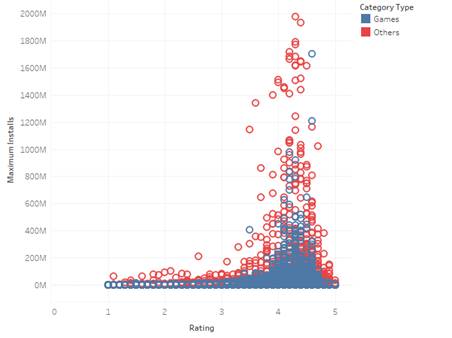

Ratings vs Installs

Zoomed In to 2 Billion Downloads

A closer look shows how most

apps are rated between 4 and 5. Furthermore, rating 5 did not necessarily mean

a high number of users for the app.

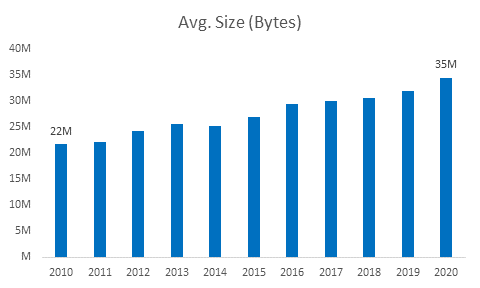

1.14 App Size

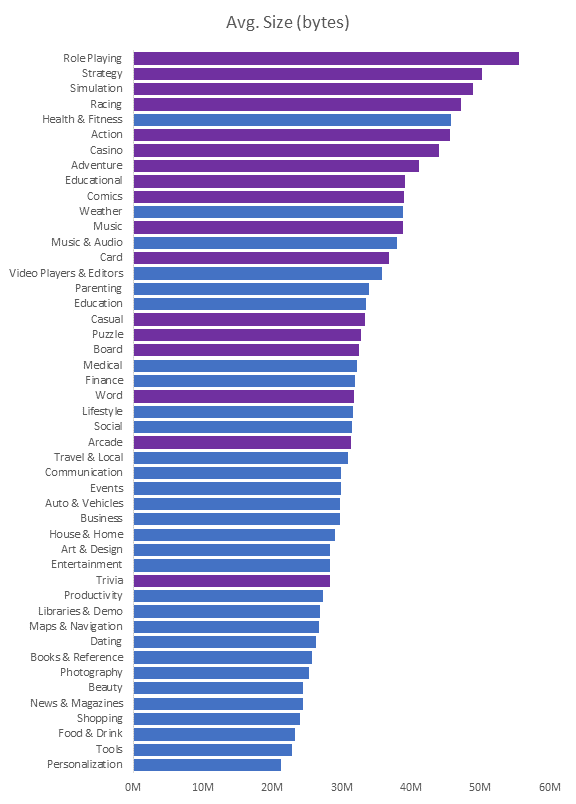

Insights: The average size of apps have increased over the

time. The apps now have grown more than 50% in size on an average.

Insights: The games categories have greater size on average. 9

of the 10 categories from the top were games

2.0 Exploratory Data Analysis

2.1 Summary Statistics of the numeric variables

2.1.1 Feature Statistics

|

Feature |

Mean |

Median |

Dispersion |

Min. |

Max. |

Missing |

|

Size (bytes) |

31,867,838 |

24,000,000 |

0.85 |

10,000 |

1,020,000,000 |

1,095,684 |

|

Install Plus |

113,540 |

100 |

76.88 |

0 |

10,000,000,000 |

0 |

|

Rating |

2.20 |

3 |

0.96 |

0 |

5 |

0 |

|

Rating Count |

2,760 |

6 |

72.02 |

0 |

138,557,570 |

0 |

|

Maximum Installs |

308,117 |

706 |

71.69 |

0 |

12,057,627,016 |

0 |

|

Price |

0 |

0 |

25.40 |

0 |

400 |

0 |

|

Released |

1/28/2010 |

6/16/2021 |

0 |

|||

|

Last Updated |

2/9/2009 |

6/16/2021 |

0 |

2.1.2 Feature statistics of the sample:

As the data was very large,

they could not be analyzed directly through analysis. Hence, the focus was

shifted to rated Games only, and a sample was created using Data Sampler from

Orange with only 1000 data. The rest of the analyses were done based on this

data.

|

Feature |

Mean |

Median |

Dispersion |

Min. |

Max. |

Missing |

|

Size (bytes) |

40,939,499 |

33,000,000 |

0.74 |

12,000 |

1,020,000,000 |

45,757 |

|

Install Plus |

355,281 |

1,000 |

13.03 |

0 |

1,000,000,000 |

0 |

|

Rating |

4.1 |

4.2 |

0.15 |

1 |

5 |

0 |

|

Rating Count |

12,147 |

55 |

26.04 |

5 |

89,177,097 |

0 |

|

Maximum Installs |

930,366 |

8,385 |

11.32 |

0 |

1,704,495,994 |

0 |

|

Price |

0 |

0 |

17.33 |

0 |

400 |

0 |

|

Released |

|

|

|

2/26/2010 |

6/27/2021 |

0 |

|

Last Updated |

|

|

|

12/28/2010 |

6/15/2021 |

0 |

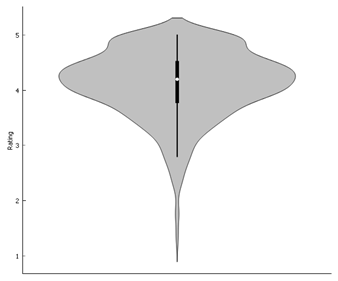

2.2 Distribution of the Ratings in sample data

2.2.1 Overall

Most apps get rated slightly

above 4.

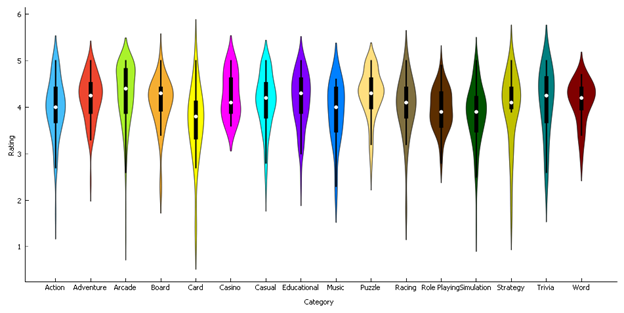

2.2.2 By Category

In the sample, some

categories are more distributed than the others. Casino category was

less distributed whereas Card category was more distributed than the

rest. The average rating of each category looks different.

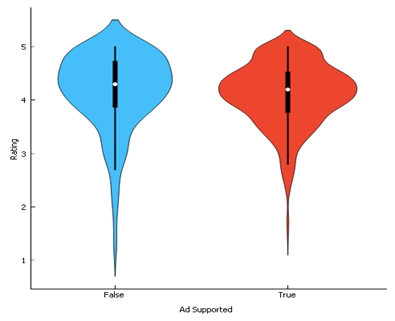

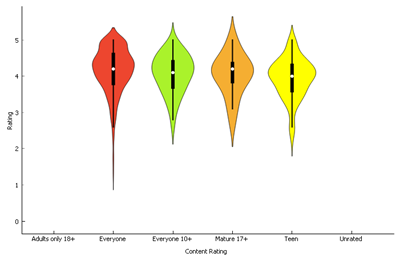

2.2.3 Whether the App supports Ads

Apps not supporting apps have

greater variations of rating than those which supports ad.

2.2.4 By Content rating

The distributions of age

restricted apps look similar to each other but different from apps without

restrictions. Age restricted apps were neither rated too high, nor too low in

the sample.

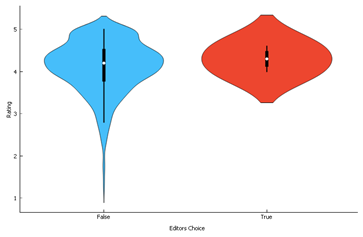

2.2.5 Editor’s Choice Apps

Editor’s choice Apps do not

seem to have very low ratings.

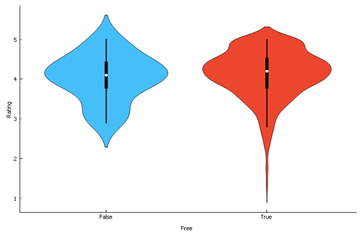

2.2.6 Free Apps

Paid apps do not seem to have

very low ratings as seen in free apps.

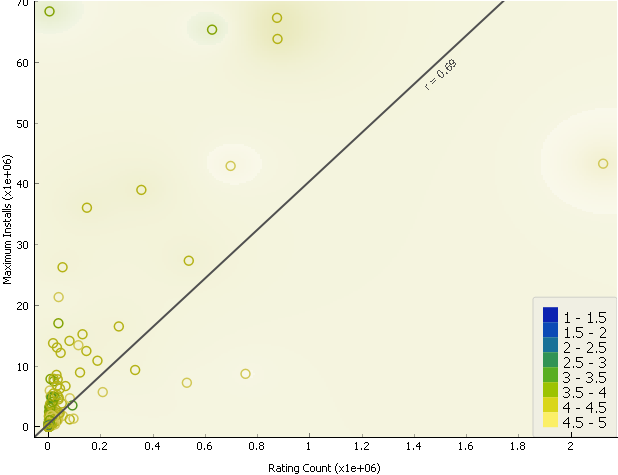

2.3 Correlations of the numeric variables

|

Feature 1 |

Feature 2 |

Correlation |

False Discovery Rate |

|

Maximum Installs |

Rating Count |

+0.69 |

5.83E-142 |

|

Last Updated |

Released |

+0.60 |

3.42E-97 |

|

Last Updated |

Size (bytes) |

+0.24 |

4.21E-14 |

|

Released |

Size (bytes) |

+0.18 |

2.15E-08 |

|

Rating Count |

Released |

-0.12 |

0.00028789 |

|

Maximum Installs |

Released |

-0.12 |

0.000295943 |

|

Last Updated |

Maximum Installs |

+0.12 |

0.000420386 |

|

Price |

Released |

-0.11 |

0.00185623 |

|

Last Updated |

Rating Count |

+0.09 |

0.0102406 |

|

Rating |

Size (bytes) |

-0.08 |

0.0162556 |

|

Rating |

Released |

+0.08 |

0.0206284 |

|

Maximum Installs |

Size (bytes) |

+0.07 |

0.0322879 |

|

Rating Count |

Size (bytes) |

+0.05 |

0.236459 |

|

Rating |

Rating Count |

+0.04 |

0.307187 |

|

Last Updated |

Rating |

+0.04 |

0.307187 |

|

Last Updated |

Price |

-0.02 |

0.619583 |

|

Maximum Installs |

Price |

-0.02 |

0.671249 |

|

Price |

Rating |

+0.01 |

0.817149 |

|

Maximum Installs |

Rating |

+0.01 |

0.817149 |

|

Price |

Size (bytes) |

+0.01 |

0.859692 |

|

Price |

Rating Count |

-0.01 |

0.859692 |

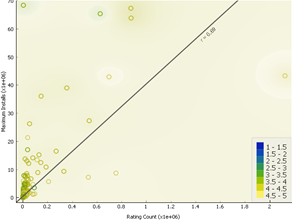

There is a weak correlation

between most of the features. The only two good correlations are not relevant

to app ratings. The strong correlation between the number of installs and the

number of ratings is visualized in the following.

High Correlation

Scatter Plot

Number of ratings are high

when installs are more. There is a correlation of 0.69 between these two.

2.4 ANOVA and T-Test

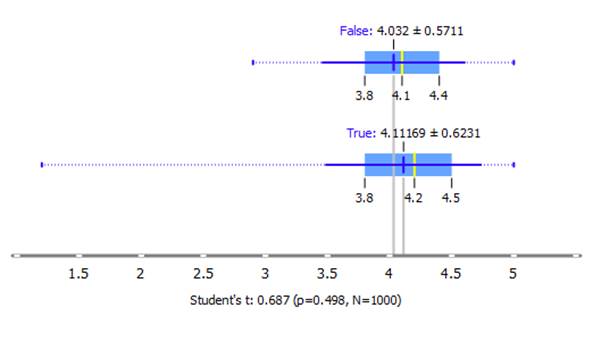

2.4.1 T-Test

Ratings by Free Apps

H0: There is no difference in rating

between free and paid apps

H1: Ratings are significantly different

between the groups

In the following figure, True means Free Apps, whereas

False means Paid.

Result:

t= 0.687 (two-tailed, p=0.498, N=1000)

The null hypothesis is not rejected.

The result is not significant at p < .05

That is, app rating does not depend on whether it is

free or not.

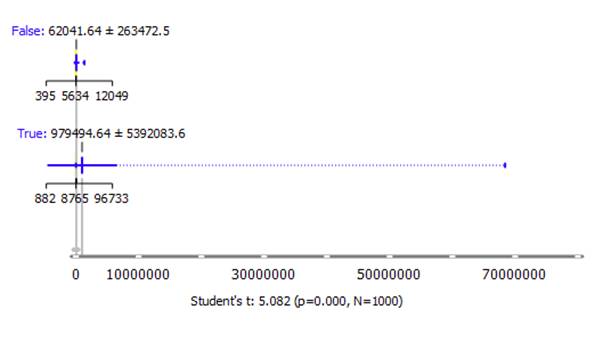

Installs by Free Apps

H0: There is no difference in the number of

installs between free and paid apps

H1: Installs are significantly different

between the groups

In the following figure, True means Free Apps, whereas

False means Paid.

Result:

t=5.082 (two-tailed, p=0.000, N=1000)

The null hypothesis is rejected.

The result is significant at p < .05.

That is, a significant difference exists. From the box

plot, free apps have a higher number of installs.

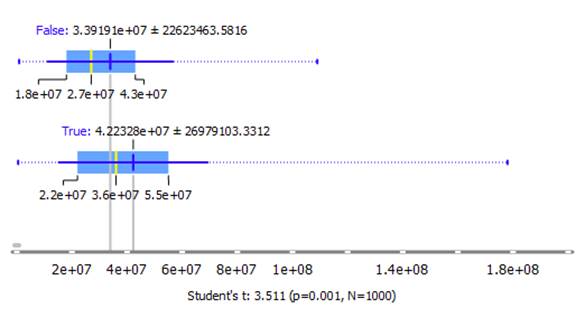

Size by Updated Apps

H0: Size of apps are not dependent on

whether apps have been updated or not

H1: Size of the apps are significantly

different between the groups

In the following figure, True means Updated, whereas

False means Not Updated.

Result:

t = 3.511 (two-tailed, p=0.001, N=1000)

The null hypothesis is rejected.

The result is significant at p < .05.

That is a significant difference exists. From the box

plot, updated apps have a higher app size compared to those that are not.

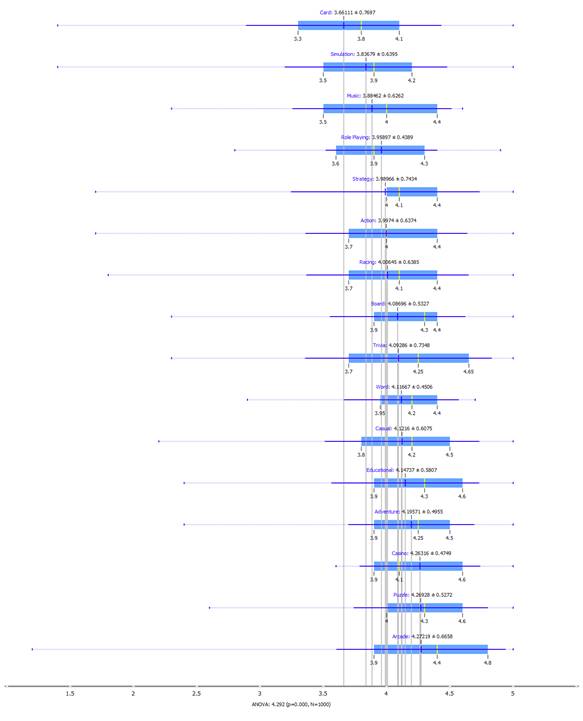

2.4.2 ANOVA

Rating by Category

H0: The mean

ratings for all categories are equal.

H1: The sample

means are not all equal

Result: ANOVA= 4.292 (p=0, N=1000)

For p=0.0, we can reject the

null hypothesis. Therefore, the ratings are dependent on the categories for

at least one of them.

Install

H0: The mean

number of installs for all categories are equal.

H1: The sample

means are not all equal

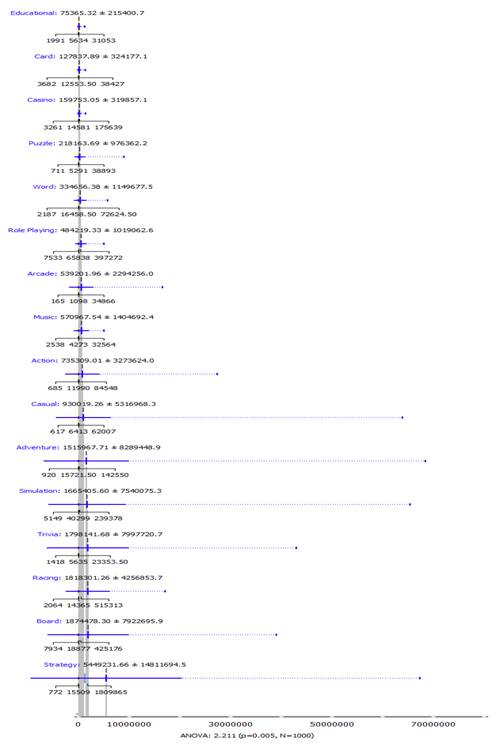

Result: ANOVA= 2.211 (p=0.005, N=1000)

For p=0.005, we can reject

the null hypothesis. That is, the number of installs vary depending on the

categories.

2.5 Outlier Detection

2.5.1 Feature Statistics of Outliers

The outlier’s that were

common through 3 methods Covariance Estimator (100 outliers), Local Outlier

Factor (100 outliers), and Isolation Forest (90 outliers) were chosen. A total

of 15 rows were found common as outliers.

|

Feature |

Mean |

Median |

Dispersion |

Min. |

Max. |

Missing |

|

Size (bytes) |

78,090,909 |

77,000,000 |

0.45 |

36,000,000 |

151,000,000 |

4 |

|

Rating |

4 |

4 |

0.08 |

4 |

5 |

0 |

|

Rating Count |

399,610 |

144,367 |

1.40 |

3,269 |

2,122,374 |

0 |

|

Maximum Installs |

32,354,101 |

26,272,965 |

0.74 |

1,268,404 |

68,398,433 |

0 |

|

Price |

0 |

0 |

0 |

0 |

0 |

|

|

Released |

44,373 |

43,848 |

0 |

|||

|

Last Updated |

43,437 |

44,362 |

0 |

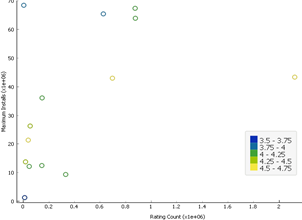

2.6.2 Scatter Plot of the Highly Correlated Features

The highly correlated

features are used below to show how the outliers are different.

All

Outlier’s only

Most outliers remained above

the regression line, which denotes high installs with a very low number of

ratings given. Excluding such outliers may increase correlation.

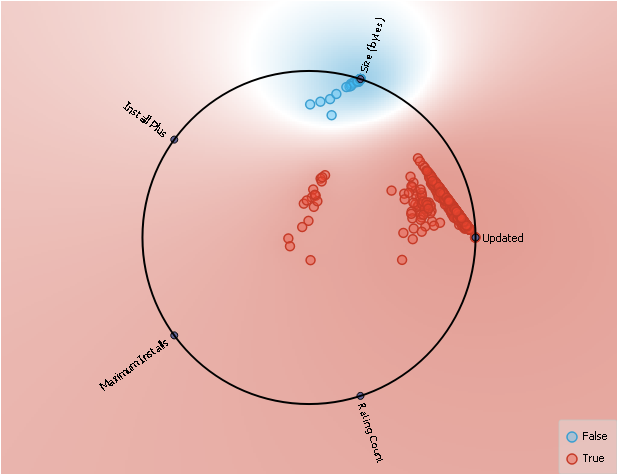

2.6 RADVIZ

Of the features related to

App Ratings, app size was relevant when, the app had not been updated.

2.7 Unsupervised Machine Learning

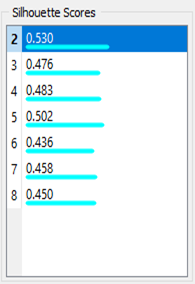

2.7.1 K-means Clustering

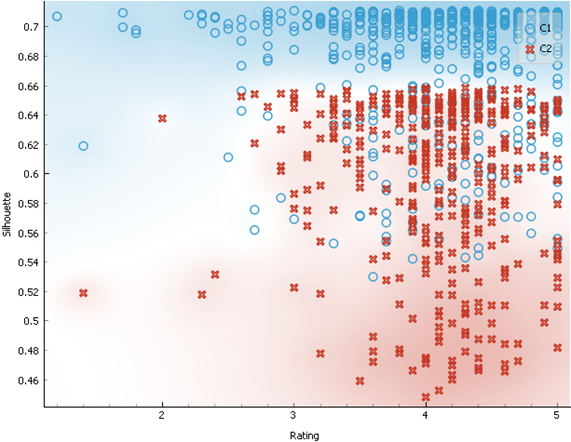

2 clusters were made as it showed the highest silhouette score.

As shown in the chart below, clusters can be separated somewhat distinctively.

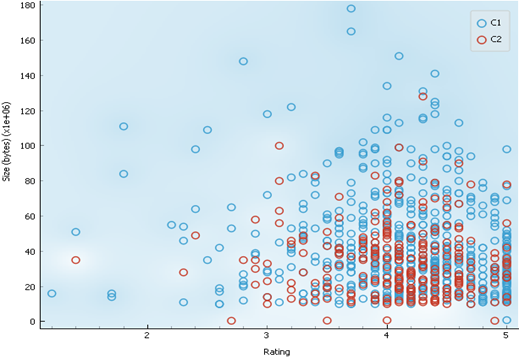

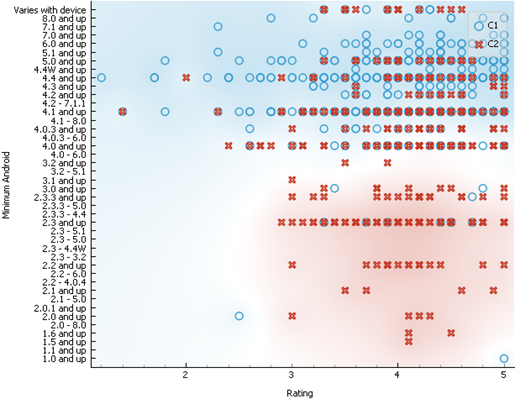

2.7.2 Cluster Characteristics

1. According to the chart below, cluster 1 can have

very high app size, compared to cluster 2

2. According to the chart, cluster 2 consists of apps

that support older app version. Whereas, cluster 1 consists of apps that are

supported by only newer app versions.

3.0 Supervised Machine Learning

Type – 1

3.1 Target Variable (Rated/Unrated)

We will be checking whether

an app gets rated or not and what models best predict such getting rated.

3.2 Removal of Collinearity

Ratings, and Rating Counts

have been removed as they directly indicate whether an app is rated or not. For

example, 0 rating means an app is unrated or, if the number of rating is 0, it

means it was not rated. Last update date has been removed as it is highly

related to the date of release. Categories have been brought under broader

categories of Games vs Others.

3.3 Data Sampling

1000 data rows have been

taken with random sampling. The proportion of rated and unrated apps were about

1:1 in the original set, hence no change was required to make the data sample

more balanced.

3.4 Model Evaluation Results

|

Model |

AUC |

CA |

F1 |

Precision |

Recall |

|

Constant |

0.496 |

0.537 |

0.375 |

0.288 |

0.537 |

|

SGD |

0.500 |

0.515 |

0.495 |

0.503 |

0.515 |

|

SVM |

0.521 |

0.466 |

0.326 |

0.506 |

0.466 |

|

kNN |

0.577 |

0.563 |

0.563 |

0.563 |

0.563 |

|

AdaBoost |

0.731 |

0.733 |

0.733 |

0.733 |

0.733 |

|

Tree |

0.808 |

0.809 |

0.809 |

0.810 |

0.809 |

|

Random Forest |

0.879 |

0.812 |

0.812 |

0.812 |

0.812 |

|

Naive Bayes |

0.895 |

0.832 |

0.832 |

0.832 |

0.832 |

|

Logistic Regression |

0.896 |

0.783 |

0.779 |

0.828 |

0.783 |

|

Gradient Boosting |

0.910 |

0.836 |

0.836 |

0.837 |

0.836 |

|

Stack |

0.913 |

0.835 |

0.842 |

0.865 |

0.821 |

The blue highlights represent

a better performance by a model, compared to red ones. There is no single model

that predicts better than the others in terms of all the different scores.

3.5 Model Comparison by AUC (Area Under the Curve)

The above matrix shows the

probability that a model in the row is better than the model in the

corresponding column. From this matrix we can see that, the two models in the

bottom rows show 100% probability to be better than most other models.

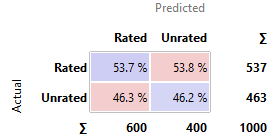

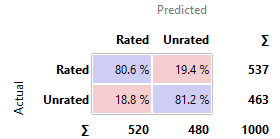

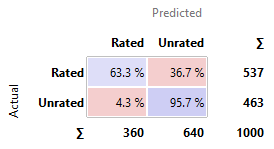

3.6 Confusion Matrix

3.6.1 Summary

From the confusion matrices

mentioned in the next page, we can summarize the following about the models

that have been used.

· kNN, SVM, and SGD perform similarly poor in comparison to the other

models. Their predictions are nearly as good as the constant model, with around

50-60% chances to have predicted correctly.

· AdaBoost, Tree, and Random Forest performed moderately well. But as significantly

better models were available, they are not focused as much.

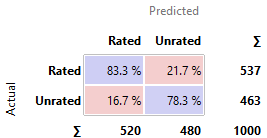

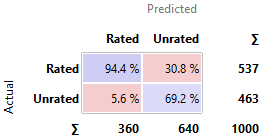

· Logistic Regression was the best model to predict rated apps. 94.4% of the

times, the app it predicts to be rated actually is rated.

·

Naïve Bayes is the best in being accurate with its

unrated prediction. 81.6% of the times, if this model predicts an app to be

unrated, it actually is unrated.

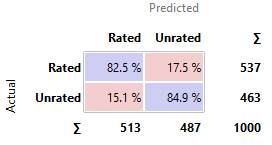

·

Gradient Boosting is the best model overall based on AUC,

CA, F1, Precision, Recall scores. It has a good balance in predicting rated and

unrated apps.

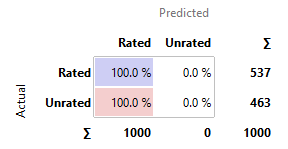

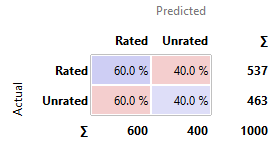

3.6.2 Bad Models

Constant

|

Proportion of actual |

Proportion of Predicted |

|

|

|

kNN

|

Proportion of actual |

Proportion of Predicted |

|

|

|

SVM

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Stochastic

Gradient Descent

|

Proportion of actual |

Proportion of Predicted |

|

|

|

3.6.3 Moderately Good Models

AdaBoost

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Tree

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Random Forest

|

Proportion of actual |

Proportion of Predicted |

|

|

|

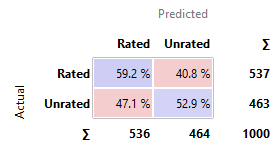

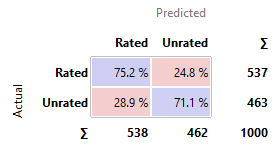

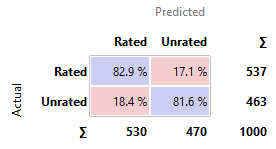

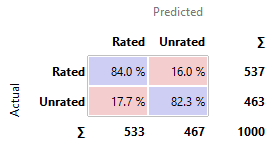

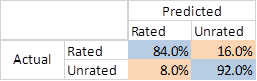

3.6.3 Good Models

Logistic

Regression

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Comment: Apps are

the most likely to be actually rated when it is predicted to be rated by Logistic

Regression.

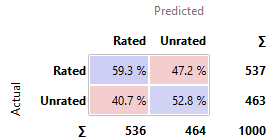

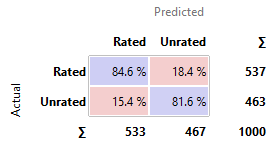

Gradient

Boosting

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Comment: Best model

overall.

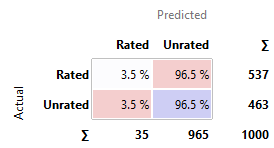

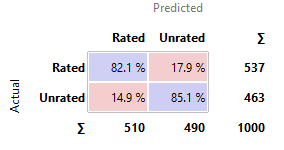

Naïve

Bayes

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Comment: Apps are

the most likely to be actually unrated when it is predicted to be unrated by

Naïve Bayes.

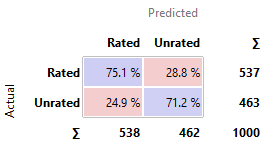

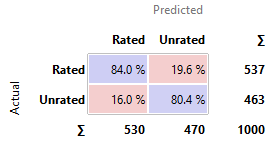

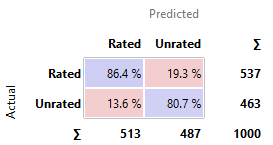

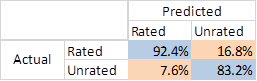

3.7 Combining Models

3.7.1 Stacking Models

Based on the confusion

matrices, Gradient boosting was paired with Logistic regression

and Naïve Bayes.

|

Proportion of actual |

Proportion of Predicted |

|

|

|

This model has slightly

better AUC than the best lone model, Gradient Boosting. It has a comparatively

lower precision and higher recall compared to Gradient Boosting.

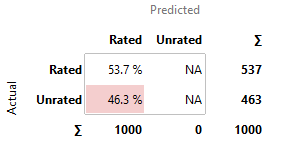

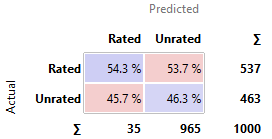

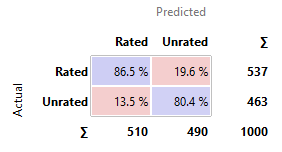

3.7.2 Setting Priorities

Based on the confusion

Matrices, we set priorities on which models will predict rated or unrated apps

in the following order.

1.

Logistic Regression will be used to

predict Rated apps only

2.

From the remaining apps, Naïve Bayes

is used for predicting unrated apps

3.

From the remaining apps, the

predictions from Gradient Boosting are used.

|

Proportion of actual |

Proportion of Predicted |

|

|

|

Based on the table above,

this combined model predicts both the rated and unrated apps better than all

other models.

Hence, the model

mentioned above, that uses three models on priority basis should be used.

Type – 2

3.8 Target Variable (App Rating)

We would attempt to predict

the app ratings.

3.9 Model Comparison

The errors from 5 models to

predict ratings were compared below.

|

Model |

MSE |

RMSE |

MAE |

R2 |

|

Linear Regression |

0.336 |

0.580 |

0.438 |

0.130 |

|

kNN |

0.307 |

0.554 |

0.425 |

0.206 |

|

SVM |

0.162 |

0.403 |

0.314 |

0.580 |

|

Gradient Boosting |

0.161 |

0.401 |

0.301 |

0.584 |

|

Random Forest |

0.077 |

0.277 |

0.186 |

0.802 |

Based on the comparison

table, Random Forest model gives the lowest error in all cases with R2

value of 0.808. This is the best model to among the five tested. On the

contrary, the Linear Regression method produced greater errors

while having a lower R2 value.

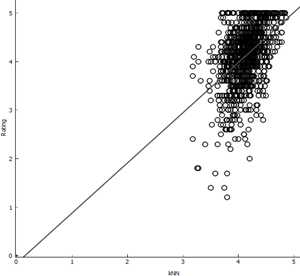

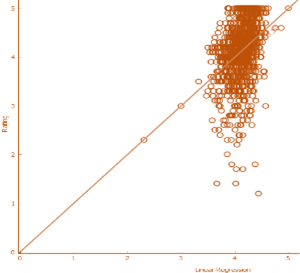

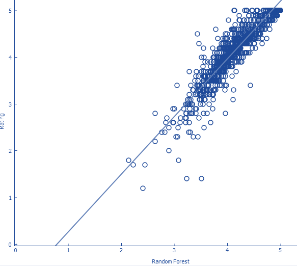

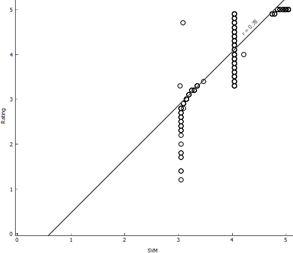

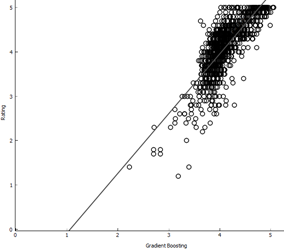

3.10 Visualizing Models

Below, the actual ratings are

plotted against the predicted ratings to understand how the predictions are different

from reality.

|

kNN |

Linear Regression (Bad fit) |

|

Random Forest (Best fit) |

SVM |

Gradient Boosting

As we can see, for Random

forest, SVM and Gradient Boosting the predicted ratings are close to actual

ratings. On the contrary, for linear regression and kNN the predicted values

are scattered very distantly.

Hence, for predicting

ratings, Random Forest is the better model.

END